Shares of SoFi Technologies (SOFI) are down over 56% from their all-time high in mid-June. The stock is down slightly from its previous all-time high, but that doesn’t mean that it is in a bear market. Read on to learn why the company may not be a good buy at this point. There is one reason why the Target Price For SOFI stock is down so far. It is currently trading near its all-time low, and there is a good chance that it will rebound soon.

Table of Content

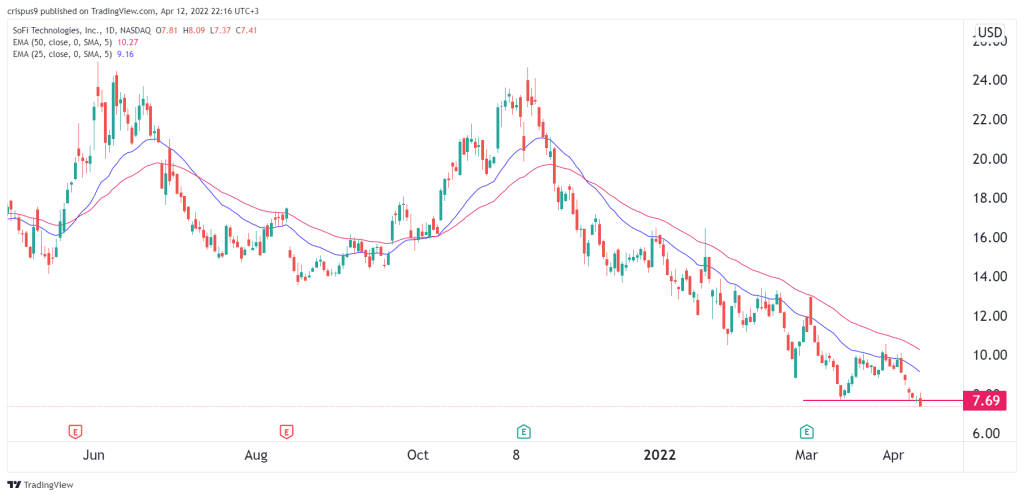

Shares of SoFi Technologies (SOFI) are down more than 56% from their peak in mid-June last year

SoFi Technologies (SOFI) shares have suffered sharp losses since going public in June 2021. They are down more than 56% from their mid-June highs, a massive sell-off that’s consistent with a general weakness in growth stocks. The company received a bank charter in mid-January, which analysts considered a crucial step in transitioning from a pure-play lender to a diversified financial services firm. The charter approval was enough to help SoFi stocks recover about half of their YTD losses, but shares still fell nearly 30%, making them one of the worst performers on the market.

The company’s recent earnings report did not help the company’s stock price. Analysts had forecast $343.7 million in second-quarter revenue. But the company’s management believes that some of the numbers cited by Wall Street are outdated. SoFi has also reduced its FY2022 revenue forecast by 70%, leaving shareholders with a $4 billion market cap.

SOFI stock is in a bear market

The bear market in tech stocks has taken a particularly hard toll on financial technology companies, otherwise known as fintechs. Companies like SoFi Technologies, LendingTree, and other fintechs have lost 25% or more year-to-date. These companies were also hit hard by the government halting payments on student loans. SoFi stock is down 7.5% on pre-market Monday, but the company has not completely disappeared.

In a bear market, the overall stock market declines 20% or more from its high. Last time, we experienced a bear market two years ago, at the start of the Covid-19 pandemic, and in 2009 during the financial crisis. Bear markets tend to occur every three to four years, and it is impossible to predict when they will happen next. However, investors should always prepare for them. If they are prepared for them, investing in stocks during a bear market is a great idea. When the market recovers, these stocks could rise in value. If you do not, you could be setting yourself up for a big loss.

SOFI stock is down near its all-time low

SoFi Technologies (NASDAQ:SOFI) is down nearly 81% from its recent high, but has rallied strongly from that low. The company’s stock was expected to report earnings this week, and the market had lost confidence when it hit an all-time low last week of $4.82. Shares had fallen so far, social media accounts were full of angst, and SoFi was down near its all-time low.

Despite being a multibillion-dollar company, SoFi is still not profitable, despite its aggressive acquisitions and recent growth. Recent news of President Biden’s decision to extend the student loan payment moratorium has only compounded the problems. While SoFi continues to grow, the market is harsher on growth valuations than it is on other industries. In addition, SoFi recently revised its guidance downward for its 2022 fiscal year.

SOFI stock is in a bull market

The SoFi stock is at an all-time low and has been hammered by negative news and a conflict in Eastern Europe. It has also been hit by inflation and interest rate worries and the risk-off trade. However, the company’s stock is rising again from its recent all-time lows and is up almost 45% in 2022. The company’s market cap has been roughly $14 billion, down from $18 billion last November. The broader market’s grizzly underpinnings have caused SOFI stock to fall by 45%.

However, the recent price action suggests that some investors may have taken their profits elsewhere. In the first quarter of 2022, the Baron FinTech Fund closed its position in the company, and Morgan Stanley downgraded the shares from overweight to equal weight. Morgan Stanley also lowered its price target to $10 from $18 citing the likelihood of an extended federal student loan moratorium. However, if the company can continue to show strong growth in the next few years, it could be a top stock to consider buying.

SOFI stock is down near its 200-day moving average

The price of SOFI stock has dropped nearly 25% in recent days. Its share price had made multi-month highs at a time when most stocks are at a bottom. However, the stock fell in recent days as selling pressure from investors grew across the industry. Recently, SoFi cut its stake by about 15%, while SoftBank cut its stake by 20%. Still, SoftBank still owns 95 million shares.

First, SOFI is doing quite well margin-wise with its loans. Higher lending rates will increase its earnings per loan. In the meantime, higher rates will slow consumer demand for new loans, which is affecting most lenders. However, SoFi has not felt the negative effects of rising interest rates. As a result, the stock is still relatively cheap relative to other companies in the same sector. If you are an investor, now is a good time to consider SOFI stock.